I was recently on the Mark Reardon Show on KFTK in St. Louis to talk about CEI’s new Ten Thousand Commandments report.

The audio is here, and starts about 23 minutes in.

I was recently on the Mark Reardon Show on KFTK in St. Louis to talk about CEI’s new Ten Thousand Commandments report.

The audio is here, and starts about 23 minutes in.

Comments Off on On the Radio: Ten Thousand Commandments

Posted in Media Appearances, Reform, regulation

This news release was originally posted at cei.org.

WASHINGTON – Sen. Rick Scott (R-FL) recently introduced S. 2239, the Unnecessary Agency Regulations Act of 2021, a law that would require the Office of Management and Budget’s Office of Information and Regulatory Affairs (OIRA) to identify new regulations each year that are obsolete, redundant, or burdensome, and to send Congress a list of such rules to consolidate or remove. The bill also requires Congress to actually act on those recommendations. The House version, H.R. 4132, was introduced this week by Rep. Byron Donalds (R-FL).

CEI senior fellow Ryan Young said:

“As we emerge from the COVID-19 pandemic, America needs both short-term recovery and long-term resilience. The Unnecessary Agency Regulations Act of 2021 contributes to both. In the short term, a regulatory housecleaning will help new businesses start up more smoothly, and help existing businesses hire employees and grow again. In the long run, regular pruning of redundant, obsolete, and burdensome rules will help keep agencies and businesses resilient against the next crisis.

“Trillions of dollars of politically motivated infrastructure and stimulus spending will not help the COVID recovery. It will simply take money away from some projects and put it into other projects instead. A deregulatory stimulus, of which this bill should be a part, would make it easier for people to create new opportunities and new wealth, without adding to the deficit.”

CEI Vice President for Policy Wayne Crews said:

“As a hidden tax that rivals the explicit one we deal with every April 15, the burdens of federal regulation require far greater disclosure than is currently required and a mechanism to slow down the constant flow of new rules. Some 3,000 rules and regulations appear annually in the Federal Register, and, minus aberrations like former president Donald Trump’s one-in, two-out campaign, little or no rollback happens. One gauge of regulation we get, OMB’s Report to Congress on Regulatory Costs and Benefits, is chronically months or years late and hopelessly incomplete when it does show up. Another disclosure tool, the twice-yearly Unified Agenda of Federal Regulatory and Deregulatory Actions, ostensibly presents agency regulatory priorities but is non-binding. While administrative state supporters will inevitably fret that OMB lacks the necessary staff to identify redundant, burdensome and obsolete rules – let alone make recommendations regarding them in the Agenda. The Unnecessary Agency Regulations Act from Sen. Rick Scott points out what must be done in tomorrow’s amplified regulatory disclosure. If OMB cannot be allowed to suffer, neither can an over-regulated public. The solution is to reduce regulation, not ignore its volume as it flies by.”

More CEI resources on regulatory reform:

Inside Sources op-ed: How to Stimulate the Economy without Trillions in New Spending

CEI’s Agenda for Congress: Regulatory Reform

Ten Thousand Commandments: An Annual Snapshot of the Federal Regulatory State

Comments Off on CEI Supports Sen. Rick Scott and Rep. Byron Donald’s New Regulatory Reform Bill to Prune Unneeded Rules

Posted in Reform, regulation

This press release was originally posted on cei.org.

On Thursday, Senator James Lankford (R-OK) introduced the Pandemic Preparedness, Response, and Recovery Act. The bill would establish an independent commission to identify regulations harming the COVID-19 response, and compile a package for Congress to vote on.

CEI Senior Fellow Ryan Young said:

“The American economy is a lot different than it was a year ago. We are still adapting to the challenges of COVID recovery, and making the country resilient against whatever the next threat might be. Part of that effort needs to include trimming the 185,000-page Code of Federal Regulations. Much of that code is out of date, was hampering the virus response, and will slow the economic recovery going forward.

“An independent commission like the one in the PPRRA is an effective way to go through all those rules and figure out which ones are worth keeping, and which ones the country is better off without. This is not a red-team/blue-team issue. It is a common sense issue, with a bipartisan heritage going back to the successful BRAC commissions of the 1990s that saved billions of dollars in military spending. Congress and President Biden should jointly pursue this bill or something like it.”

CEI Vice President for Policy Wayne Crews said:

“At a time when the administration is passing trillions of dollars of spending in an attempt to jumpstart the economy, powerful deregulatory stimulus, that is, easing or removing unnecessary rules and regulations can make our economy more resilient.

“It is up to Congress has to reassert its primary legislative role and act to reduce regulation, as this juncture ideally can do that via a bipartisan ‘regulatory improvement commission,’ an idea is rooted in bipartisan discussions stretching back over several Congresses.

“The Pandemic Preparedness, Response, and Recovery Act is a logical, sensible, fair and humane approach to dealing with crisis. Under the Act, a bipartisan commission would prepare recommendations for regulatory streamlining, and those would be improved upon by public notice and comment. The resultant report would be issued to Congress, which would have the ability to say yes or no to this new vehicle uniquely expressing an aspect of the will of the people that too often gets neglected. While the regulatory code grows with little relief, the Pandemic Preparedness, Response, and Recovery Act provides a way of disciplining it for the public good, and health.”

Read more:

Comments Off on CEI Commends Sen. Lankford for Introducing Pandemic Preparedness, Response, and Recovery Act

Posted in #NeverNeeded, Economics, institutions, Reform, regulation

CEI’s new agenda for Congress is out now. If you’re interested only in certain issues, individual chapters are downloadable here. We also hosted a launch event yesterday featuring Sen. Rand Paul (R-KY).

The first chapter is on regulatory reform. The focus here is not so much on individual rules, but on the rulemaking process itself. If there is a key message, it is that institutions matter. If you want a better game, you need better rules for the game. Effective reforms don’t just treat symptoms; they treat root causes, too.

To that end, here are a few principles for sound reform:

We also suggest specific reforms based on these principles:

These reforms should apply to independent agencies as well as cabinet-level agencies. Independent agencies, which constitute roughly two thirds of all rulemaking agencies, are currently exempt from many transparency and rulemaking requirements that apply to other agencies. This is bad institutional design, and should be fixed.

For more ideas, see chapter one of Free to Prosper, CEI’s new agenda for Congress. The entire agenda is here.

Comments Off on Agenda for Congress: Regulatory Reform

Posted in Political Animals, Reform, regulation

Yesterday I spoke on a panel discussion hosted by the Pacific Legal Foundation. The topic was opportunities and challenges for enacting sound policy in the year to come. PLF president Steven Anderson moderated, and the other panelists included the State Policy Network‘s Jennifer Butler and Greg Brooks of the Better Cities Project.

The event is viewable on YouTube here.

Comments Off on Event: Reviving America after a Year of Chaos

Posted in #NeverNeeded, Media Appearances, Minimum Wage, Political Animals, Reform, regulation

Neither presidential candidate has much interest in limited government. But over at National Review, I look at some neglected down-ballot victories from the 2020 election. A divided Congress will prevent one party from running everything, regardless of who wins the White House. There were also several state-level victories across the country.

California voters partially undid the AB5 gig-worker law that made unemployment even worse during the pandemic. They also voted against an expansion of rent control, which is one reason California’s housing prices are so high.

Not that legislators will listen, but Illinois voters sent them a message to address the state’s pension crisis by cutting spending rather than raising taxes:

The Illinois legislature had already passed a separate tax hike bill, conditional on voters approving the amendment. Voters disapproved by a 55-45 margin, and taxes will remain as they are.

Voters in Oregon and several other states also continued to deescalate the drug war:

In order for people to respect the law, they have to be able to respect it. That was a major cultural cost of alcohol prohibition in the 1920s, and of the drug war today. Drug legalization allows law enforcement to focus on real crimes and ease an avoidable source of antagonism between police officers and the communities they serve—especially in minority areas where drug laws are disproportionately enforced.

Washington state voters registered disapproval of a plastic bag tax. This is a victory for my colleague Angela Logomasini, who has written about the issue here and here.

A lot went wrong in the 2020 election, as is true every year. But some things also went right. Now let’s build on those victories and create some new ones.

Read the whole thing here. Ideas for the next free-market victories are at neverneeded.cei.org.

Comments Off on The 2020 Election Actually Had Some Free-Market Victories

Posted in #NeverNeeded, Economics, Elections, labor, Nanny State, Publications, Reform, regulation, Taxation

CEI’s approach to regulatory reform has an overarching theme: It is not enough to get rid of this or that harmful regulation. For the benefits to last, there must be system-level reform to the rulemaking process that keeps generating those rules. Institutions matter. One of the best of those institution-level reform ideas now has COVID-19-focused legislation at the ready: the independent regulatory reduction commission.

Senators James Lankford (R-OK), Ron Johnson (R-WI), and Rob Portman (R-OH) have introduced the Pandemic Preparedness, Response, and Recovery Act (PPRRA). The House version was previously introduced by Rep. Virginia Foxx (R-NC). The bill would establish an independent commission to identify regulations harming the COVID-19 response, and compile a package for Congress to vote on.

Wayne Crews and I have a statement supporting the idea here.

The idea is not new. Former Sen. Phil Gramm introduced a version of the idea back in the 1980s. The Base Realignment and Closure (BRAC) commissions that closed unneeded military bases had four rounds in the 1990s, and saved billions of dollars. CEI has been promoting the idea for more than a decade, most recently in a Washington Examiner op-ed and #NeverNeeded paper. Several other legislative versions of the regulatory BRAC commission have been introduced by lawmakers from both parties.

The time to act is now. If House and Senate leadership, not wanting to make any waves before the election, do not act, then the PPRRA should be reintroduced in the next Congress, and on and on until it passes. Regulatory reform is a long game, but with people hurting from COVID-19 and a tough recovery ahead, this is an idea that Congress should act on now.

Comments Off on Senators Introduce Regulatory Commission Bill

Posted in #NeverNeeded, Reform, regulation

In a new CEI video, Kent Lassman talks about three things agencies can do rein in regulations that are hindering the COVID-19 response and making economic recovery even harder. Congress should establish an independent regulatory reduction commission. Agencies should go over their own rules and policies and prune them. And new rules should have automatic sunsets

On their own, members of Congress have neither the incentive nor the ability to thoroughly trim regulations. So, they should do what they did the last time they hit an impasse like this—establish an independent commission. When the Cold War ended and the military needed fewer bases, no one representative would vote to close the one in his or her district, even if the base’s resources would do more good if used differently, because they didn’t want to face the political backlash.

The Base Realignment and Closure (BRAC) commission solved the problem. It studied the situation and sent Congress a plan for which bases to keep and which to shrink or close. This was then put to an up-or-down vote, without possibility for amendment. The streamlining of the military worked. Individual members of Congress could avoid blame for specific base closures. And voters understood that if their base was affected by BRAC, it was a fair decision made for a good reason. Four rounds of BRAC saved billions of dollars.

We should do something similar for regulation. In fact, the idea has been around since the early 1980s, when Sen. Phil Gramm proposed a version of it. After other occasional proposals from both parties, Rep. Virginia Foxx (R-NC) has just proposed her version of a regulatory BRAC. It’s a good idea, and it’s being taken seriously. With regulations harming the coronavirus response and the economy, now is the time to act on it.

Agencies should also so their own housework. Executive orders from President Trump have required agencies to get rid of two old rules for each new rule they enact; publish guidance documents in a single, searchable place in order to fight against the problem of regulatory “dark matter;” and most recently, to encourage agencies to use their emergency powers to wave rules that are getting in the way of an effective COVID response.

Finally, new regulations should have automatic sunsets. Just as cartons of milk have an expiration date, so should regulations. Times change; regulations often don’t. This rule would give agencies an incentive to periodically revisit and modernize their rules. Letting obsolete or harmful ones go is as simple as doing nothing; this is a fitting setup for a Congress that is rarely brave enough to take a stand on anything.

Please share the video on social media. For more on these proposals, see my recent paper “How to Make Sure Reformed #NeverNeeded Regulations Stay That Way.” More ideas are at neverneeded.cei.org.

Comments Off on New CEI Video: Eliminating Never Needed Regulations to Help with Recovery

Posted in #NeverNeeded, Reform, regulation, Uncategorized

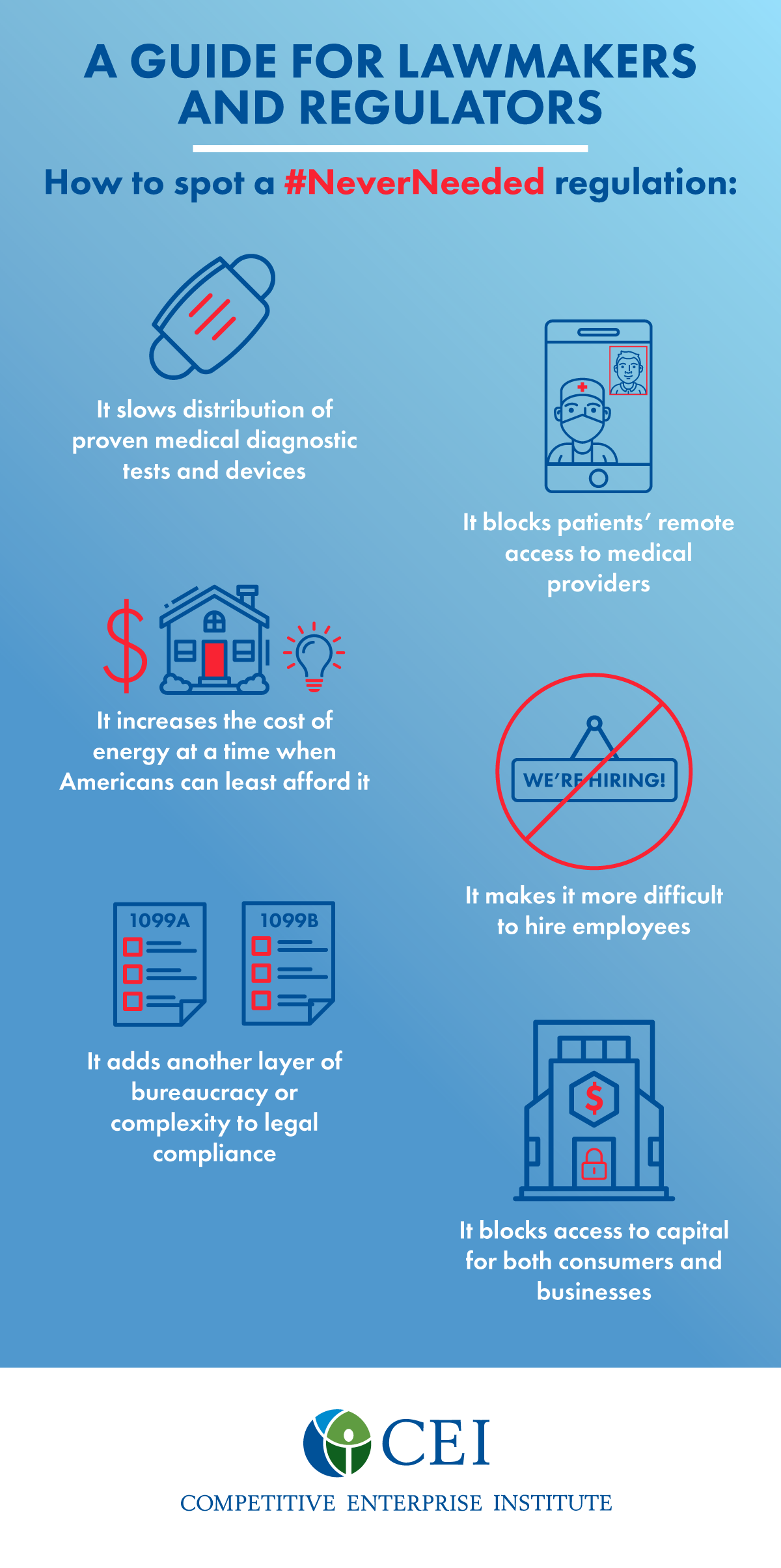

Regulatory reform is one of the most important weapons there is for fighting COVID-19 and for aiding the economic recovery after the worst passes. But with 1.1 million regulatory restrictions and 185,000 pages of rules at the federal level alone, where should policy makers start? This handy infographic shows policy makers and regulators what to look for. If a rule meets one or more of these guidelines, it is probably a #NeverNeeded regulation.

A good rule of thumb is that if a regulation isn’t needed now, during a pandemic, then it probably was never needed in the first place.

Getting rid of #NeverNeeded regulations should be a top priority for lawmakers and regulators. But it is also not enough. Regulatory sludge has been building up for decades. Federal agencies issue more than 3,000 new regulations in most years, and usually remove old or outdated rules only when forced to. Reforming the rulemaking process itself, so that it generates fewer #NeverNeeded rules going forward, will be essential to resilience against the next crisis. If net neutrality rules hadn’t been repealed, for example, people in the U.S. would have had to deal with congested, throttled networks, such as many Europeans have been dealing with. The transition to new technologies, such as telemedicine and Zoom meetings for students and workers, would have been more difficult, or even impossible.,

For more resources on identifying and reforming #NeverNeeded regulations, see neverneeded.cei.org.

Comments Off on How to Spot a #NeverNeeded Regulation

Posted in #NeverNeeded, Reform, regulation, Uncategorized

On Monday, June 22 at 11:00 ET, CEI is holding a Zoom event on regulatory reform with Paul Ray, who heads the Office of Information and Regulatory Affairs inside the Office of Management and Budget. That’s the agency most directly involved in monitoring the federal regulatory state.

Also speaking at the event are CEI president Kent Lassman, vice president for policy Wayne Crews, and me.

Registration is here. Afterwards, the event will be posted to YouTube. I’ll post a link when it’s up.

Comments Off on Speaking at #NeverNeeded Event on June 22 with OIRA Administrator Paul Ray, CEI’s Kent Lassman, Wayne Crews

Posted in #NeverNeeded, Reform, regulation, Uncategorized