Earlier this week I was on the Lars Larson show to talk about inflation. The audio is here.

I also appeared on the Dave Elswick show on the same topic. The audio is here, starting around five minutes in.

Earlier this week I was on the Lars Larson show to talk about inflation. The audio is here.

I also appeared on the Dave Elswick show on the same topic. The audio is here, starting around five minutes in.

Comments Off on On the Radio: Inflation

Posted in Economics, Media Appearances, Monetary Theory

Tagged inflation

Would raising the minimum wage help to fill the more than 10 million job vacancies currently open? It makes some intuitive sense—higher pay will attract more workers. The trouble is that minimum wages have tradeoffs that cancel out that higher pay, so it wouldn’t work. As I explain in an op-ed for Inside Sources:

Workers earn more than wages. They also earn non-wage pay. If the law requires employers to raise wages, they can and do make up the difference by cutting non-wage pay. …

Restaurant workers, for example, might lose complimentary shift meals. Customers might leave smaller tips if they believe their server is getting a higher hourly wage. A restaurant owner might decide not to hire busboys and instead ask servers to add those duties to their already full plates. Retail workers might have to pay for formerly free parking, have fewer or shorter breaks, or lose employee discounts or tuition assistance.

Some employees might get their hours cut (an obvious tradeoff for which recent Nobel laureate David Card’s famous co-authored study failed to account).

Minimum wages don’t work as intended, but there is still a lot that policy makers can do to help get people back into the workforce. They should loosen job-killing occupational licenses, reform zoning and land-use regulations that inflate rents that could instead go to paying salaries, reform financial regulations that make it difficult for companies to hire and grow, and undo Trump-era trade barriers that are sludging up supply networks.

Read the whole piece here. See also my CEI study, “Minimum Wages Have Tradeoffs.”

Comments Off on How to Fill 10 Million Vacant Jobs

Posted in Economics, Minimum Wage, Publications

It is not asking much to undo President Trump’s doubling of U.S. tariffs, which are a major contributor to today’s supply network crisis. But apparently even this is asking too much from an administration that largely shares Trump’s economic views. While the weekend’s news about the easing of steel and aluminum tariffs against the European Union was welcome, it is too small to do much good. Nor does it treat root problems.

The tariffs will actually remain in place. The U.S. will simply allow 3.3 million metric tons of EU-made steel into the U.S. duty-free before charging tariffs. For context, U.S. producers made 72 million metric tons of steel in 2020, so the exemption will have only a small effect on steel prices. Shipments beyond 3.3 million metric tons will still be charged a 25 percent tariff. In addition, the EU agreed to not enact new retaliatory tariffs that were scheduled to take effect on December 2.

Not imposing new tariffs is different from lowering existing ones. It also has a much effect. Under the new agreement, all other existing trade barriers will remain in place. Total U.S.-EU trade barriers will remain higher than they were four years ago. This is bad news for consumers and producers on both sides of the Atlantic, at a time when prices are rising and supply networks are strained.

The agreement even adds new trade restrictions where there were none before. The New York Times reports:

The agreement will also place restrictions on products that are finished in Europe but use steel from China, Russia, South Korea, and other countries. To qualify for duty-free treatment, steel products must be entirely made in the European Union.

Tariffs mean higher prices. The new exemption’s small size means that steel and aluminum prices will remain above pre-tariff levels. Cars, construction, and other steel-using industries will continue to have shortages and higher consumer prices.

The exemption will also do little to relieve strained supply networks. For example, there is now a shortage of truck trailers, called chassis, used for hauling shipping containers to and from ports. Chinese-made chassis are currently subject to 220 percent tariffs, which makes them unaffordable for many smaller trucking companies. Washington’s goal is to have them buy American-made chassis instead.

The trouble is that those tariffs also allow U.S. chassis producers to keep their prices high. They don’t have to worry about truckers turning to competitors—which is ironic in a time of rising antitrust enforcement. While that goes straight to the chassis makers’ profit margins, it harms everyone else. Ports stay clogged, truckers can’t do much to help unclog them, and consumers face higher prices and shortages. About the only winners are domestic steel producers and their labor unions, which is likely the point.

The U.S.-EU trade dispute also remains unresolved. This agreement is more of a cease-fire. A law of tariffs, rediscovered during the Trump era, is that other countries nearly always retaliate in kind against new tariffs. What happened here is that the U.S. is partially rolling back one of its new tariffs, and the EU is rolling back its retaliation. Nothing has been liberalized on net. Other long-running disputes over aerospace subsidies and other issues remain in play.

COVID-19 is still hampering the economy and supply networks are still in crisis. Now would be a good time for actual trade liberalization, rather than merely preventing another round of protectionist escalation. But on trade, as with many other issues, the Biden administration is difficult to tell apart from its predecessor.

Comments Off on Steel, Aluminum Tariffs to Remain Above Pre-Trump Levels

Posted in Economics, International, Trade

Several of my colleagues and I issued statements about the reconciliation bill Congress is currently considering. The full statement is here. My contribution is also below:

Senior Fellow Ryan Young said:

“There are two reasons for passing the infrastructure and reconciliation spending bills: fighting COVID and helping the economic recovery. They fail on both counts. Congress should turn to other policies instead. These include speeding up the FDA’s approval process for medical treatments, and lifting regulations, tariffs, permits, and licenses that are sludging up supply networks.

“Federal regulations currently cost more than $14,000 per household. Lightening that load by as little as ten percent would be an enormous stimulus that requires no new deficit spending.

“Most of the 1,684 page reconciliation bill consists of COVID-unrelated wishlist items such as more than $14 billion for forest restoration; $50 million for water research; $1 billion for antitrust enforcement; and billions of dollars in subsidies for private businesses with the right political connections.

“Because all that money has to come from somewhere else, stimulus is at best a zero-sum game. The spending bills are not creating new wealth, they are reshuffling existing wealth. Since funding is decided by politics rather than merit, the bills are almost certainly a net loss to the economy, even compared to doing nothing.

“The spending bills will use up nearly $3 trillion in capital that instead could have helped struggling businesses take loans to stay afloat or grow; that could have gone towards adapting supply networks to post-COVID conditions; and that people could have invested in themselves to improve their future prospects.”

Conservatives are different than they were just a few years ago, and it isn’t just because of Trump, who is more a symptom than a root cause. There is a larger political realignment underway, as happens every couple of generations. Previously, conservatives saw communism as the enemy, and favored free markets as a bulwark against it. But the Cold War ended a generation ago. Today, the debate isn’t over communism vs. capitalism, it’s over open vs. closed.

The latest data point in the current political realignment comes from The American Conservative’s Declan Leary, in a piece taking on Leonard Read’s classic free-market pamphlet I, Pencil (see also CEI’s video adaptation). Leary’s article is titled “We Are Not Pencils,” though the article’s URL contains the phrase “pencils are from the devil.”

This is quite a change from the days when President Ronald Reagan was photographed reading The Freeman, the magazine published by I, Pencil author Leonard Read’s Foundation for Economic Education.

At the same time, the old and new conservatives aren’t as different as they seem, despite their differences on trade, free markets, antitrust, industrial policy, and Eastern European dictators. Their different views come from the same inborn human tendency to see the world in terms of in-groups and out-groups.

Those groups can be defined by almost anything, whether serious or silly—language, race, religion, nationality, political party, sports fandom, views on whether pineapple belongs on pizza, and more. People can simultaneously belong to several of these groups, and flit between them seamlessly as social situations dictate. A Democrat and a Republican can be friends at a baseball game where they cheer for the same team, for example, then go back to bickering after the game.

I, Pencil celebrates openness, giving that 1958 pamphlet a clear position in today’s realignment. Read’s point is that cooperation is so fundamental to the human condition that no one, by themselves, can make something as simple as an ordinary pencil. Interconnectedness makes modernity possible.

Making a pencil requires millions of people working in concert. These include loggers, miners, tool makers, paint producers, truck drivers, box makers, machinery designers, farmers and restaurant workers to feed them all, retail clerks, and more. Not only that, but nobody is in charge. Nobody is following any plan. This complicated order emerges spontaneously, guided by little more than the price system and social norms.

But where Read sees a source of wonder, Leary sees a source of fragility. “The Invisible Hand wrenched away not just American jobs but America’s very capacity to produce things,” he writes. What if a link in the supply chain breaks? What if China decides to cut off America’s supply of rare earth elements? What if some politically woke truck drivers go on strike?

It would be better, Leary argues, to turn inwards a little bit. Going full Juche, as North Korea calls its philosophy of self-reliance, is obviously harmful. But on the spectrum from open to closed, Leary argues that we have gone a bit too far toward the open side, and become too vulnerable because of that. Out-groups aren’t as trustworthy as the in-group, in that view.

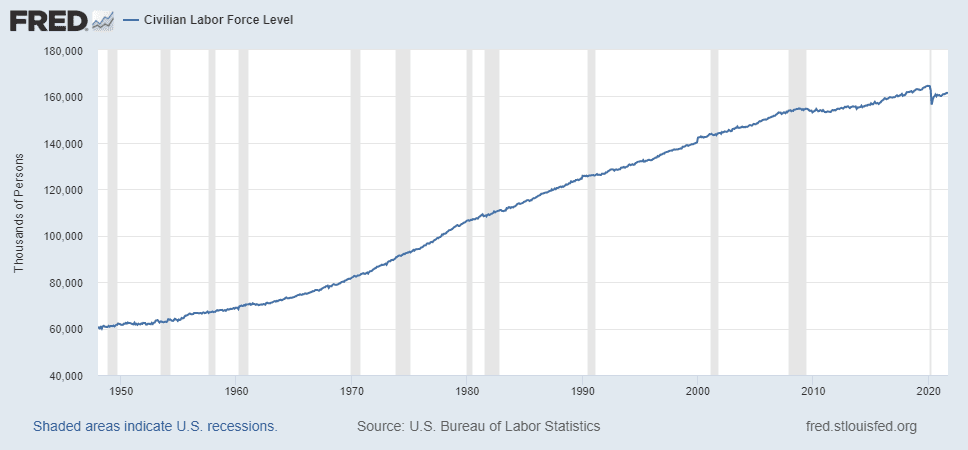

But has the invisible hand really “wrenched away American jobs?” Look at the data for the size of the U.S. labor force, going back to 1948:

Labor force size is tied most closely to population size, not how open the American economy is to foreign trade. In 2000, the labor force was 143 million people. As of September 2021, it was 161 million. That’s a net gain of 18 million jobs, even accounting for the 3 million jobs lost during the pandemic that have not yet come back.

Leary is asking the wrong question. What is important is not how many jobs, but what types of jobs there are, and how much value those workers create. A subsistence farming economy has full employment, but low living standards. A globalized, high-tech economy also often has full employment, but its similarly sized labor force has much higher living standards and longer life expectancies.

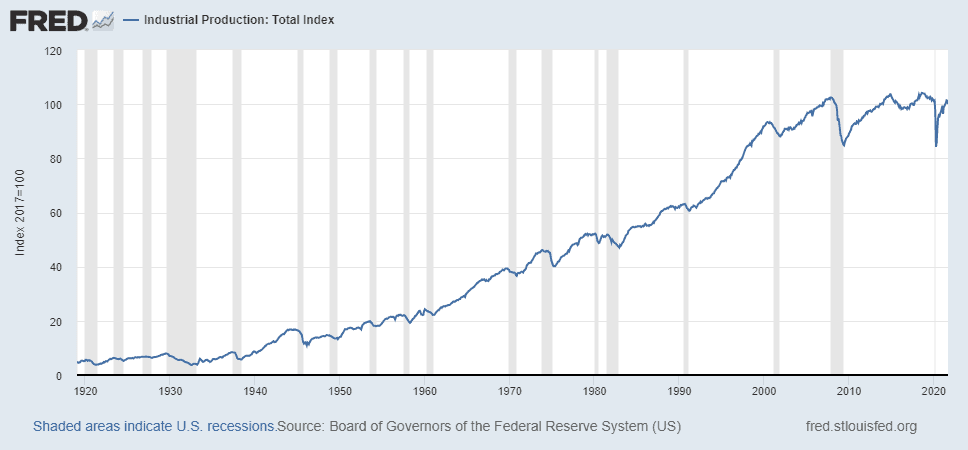

So Leary’s argument about jobs doesn’t hold. What about “America’s very capacity to produce things?” Let’s look at the St. Louis Fed’s total index for industrial production from 1920 to the present. Notice that it is near an all-time record high right now, despite a COVID-related dip:

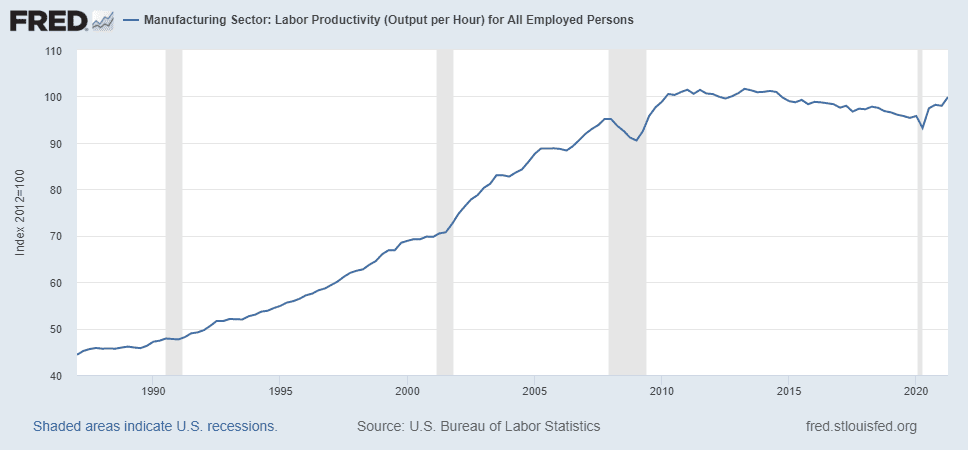

So Leary’s argument doesn’t hold there, either. To be fair, this record was set by fewer manufacturing workers. There were 12.8 million manufacturing workers when COVID hit, compared to a peak of 19.5 million workers in May 1979. That is concerning. But why is manufacturing output still higher? Because today’s workers are more productive than they were a generation ago.

This productivity surge—driven by technology, openness, and specialization—has freed up millions of people’s time and talent for other pursuits. Not only do Americans manufacture more stuff than ever before, we are also creating more service-related value, with less effort. It’s not manufacturing or services when productivity increases; it’s manufacturing and services. The pie gets bigger.

The key to mass prosperity is doing more with less. Politically directed industrial policy attempts to treat a healthy patient, while harming the rest of the economy by taking away its resources.

Moreover, the service jobs to which workers are migrating tend to pay better and have better working conditions. There is something to be said about working in an air-conditioned office or from home, rather than a noisy factory floor with potentially dangerous machinery.

Average hourly pay, as of September 2021, is $24.18 in manufacturing, versus $30.85 for the economy at large. Since wages are tied to productivity in the long run, a major reason for workers’ migration away from manufacturing is that the new types of jobs tend to create more value than the old ones.

Using government policy to migrate workers back to manufacturing jobs would mean paying many of them less. It would also mean that their hard work would create less value for people. That would be a double blow to worker’s egos, which is almost certainly not Leary’s intention. But as the economist Thomas Sowell likes to say, intentions are not results.

What about the theoretical case for more economic self-sufficiency? The first response is a simple one: Don’t put all your eggs in one basket.

Leary argues that elaborate supply chains are vulnerable. If one link breaks, the whole chain becomes useless. Fortunately, supply chains are nothing like chains. A link in a chain is connected only to the link directly ahead of it, and the one directly behind it. Real-world supply chains are more like webs or networks, where each piece is connected to nearly every other piece. That is a source of strength.

Breakages happen all the time in the real world. It’s important to have as many ways as possible to adapt and reroute. As the economist Israel Kirzner pointed out, entrepreneurship is all about alertness. Markets and supply networks are never perfect, and are always changing. Every flaw, and every vulnerability, is an opportunity for improvement. The economy is an ongoing process of experiment, trial, error, and adaptation.

But people will have fewer ways to make improvements and shore up against vulnerabilities if policies limit who they can cooperate with or confine their talents to certain industries. Industrial policy and self-sufficiency make people more vulnerable against threats because they lock people into old patterns, distort prices that convey important information, and make it more difficult to adapt. This is true whether the threat is a global pandemic, a foreign adversary, or a local labor dispute.

The economic case for why openness is more resilient than self-reliance is not new. It is not even controversial, at least among economists. But in politics, issues are often not about the merits. If Leary really is arguing against the economics, he has not succeeded. But if he’s staking out a cultural or political identity and attacking out-groups, then mission accomplished.

Leary also deserves credit for using the word “liberal” closer to its original and correct meaning—valuing freedom and openness—than do most commentators.

The insight that national conservatives and populists often care more about cultural identity than policy is key to understanding today’s political realignment. That is not to pick on conservatives; many progressives are no different. For them, too, signaling is often more important than real-world policy effects.

Affirming the in-group and vilifying the out-group is harmless at a ballgame, or in an argument about whether Star Wars or Star Trek is better. But in public policy, the stakes are higher. An old impulse that had survival benefits in hunter-gatherer times can have the opposite effect in the modern world—especially when COVID-19 is still a going concern.

It isn’t often that a pamphlet about basic economics offers insights about a political realignment that happens 60 years after its publication. But that is the case with I, Pencil. Leary would not have bothered writing about Leonard Read’s defense of openness if it didn’t strike a nerve. Fortunately for the economy and for our ability to respond to the COVID crisis, Leary’s criticisms do not hold up against real-world data or economic theory. If he instead wants to engage in culture war identity signaling, perhaps he should find ways to channel that impulse in ways that would not make America more vulnerable to threats both domestic and foreign.

For more on “I, Pencil,” see CEI’s video adaptation. See also my review of CEI Julian Simon Award winner Johan Norberg’s book Open.

Comments Off on I, Pencil Meets Today’s Political Realignment

Posted in Economics, Philosophy, Political Animals, The Market Process

From p. 401 of Peter K. Massie’s 1980 biography, Peter the Great: His Life and World:

The Tsar’s demands for money were insatiable. In one attempt to uncover new sources of income, Peter in 1708 created a service of revenue officers, men whose duty it was to devise new ways of taxing the people. Called by the foreign name “fiscals,” they were commanded “to sit and make income for the Sovereign Lord.” The leader and most successful was Alexis Kurbatov, the former serf of Boris Sheremetev who had already attracted Peter’s attention with his proposal for requiring that government-stamped paper be used for all legal documents. Under Kurbatov and his ingenious, fervently hated colleagues, new taxes were levied on a wide range of human activities. There was a tax on births, on marriages, on funerals, and on the registration of wills. There was a tax on wheat and tallow. Horses were taxed, and horse hides and horse collars. There was a hat tax and a tax on the wearing of leather boots. The beard tax was systematized and enforced, and a tax on mustaches was added. Ten percent was collected from all cab fares. Houses in Moscow were taxed, and beehives throughout Russia. There was a bed tax, a bath tax, and inn tax, a tax on kitchen chimneys and on the firewood that burned in them. Nuts, melons, cucumbers were taxed. There was even a tax on drinking water.

Money also came from an increasing number of state monopolies. This arrangement, whereby the state took control of the production and sale of a commodity, setting any price it wished, was applied to alcohol, resin, tar, fish, oil, chalk, potash, rhubarb, dice, chessmen, playing cards, and the skins of Siberian foxes, ermines, and sables. The flax monopoly granted to English merchants was taken back by the Russian government. The tobacco monopoly given by Peter to Lord Carmathen in England in 1698 was abolished. The solid-oak coffins in which wealthy Moscovites elegantly spent eternity were taken over by the state and then sold at four times the original price. Of all the monopolies, however, the one most profitable to the government and most oppressive to the people was the monopoly on salt. Established by decree in 1705, it fixed the price at twice the cost to the government. Peasants who could not afford the higher price often sickened and died.

And from p. 402:

No matter how much the people struggled, Peter’s taxes and monopolies still did not bring in enough. The first Treasury balance sheet, published in 1710, showed a revenue of 3,026,128 rubles and expenses of 3,834,418 rubles, leaving a deficit of over 808,000 rubles. This money went overwhelmingly for war.

Comments Off on Peter the Great’s Tax Policy Innovations

Posted in Books, Economics, History, International, Taxation

This press statement was originally posted at cei.org.

The number of new jobless claims fell below 300,000 for the week ended Oct. 9 — the first time since COVID-19 hit. Continuing claims fell to 2.59 million people, also the lowest level since the pandemic, but still slightly higher than average. CEI Senior Fellow Ryan Young credits increased COVID safety and a decline in government benefits and urges governments to do more to reduce barriers and resist the urge to splurge:

“One reason for the decline is expiring benefit program extensions, although the number of job openings remains at record levels. While economic fundamentals are in decent shape aside from inflation, the economic recovery is not in the clear just yet.

“The single biggest factor in the recovery has nothing to do with politics or policy—it’s COVID safety. People open up when they feel it’s safe to do so, and they close back up when they don’t. This explains a lot of the yo-yo effect in economic indicators since the pandemic began. Vaccination rates are not yet where they need to be to prevent or slow the spread of new variants, and the FDA has yet to approve promising new treatments, such as vaccines for children under 15 and a pill that can be taken at home.

“There is still plenty that policymakers should do, though. They should scrap the big infrastructure and spending bills. Not only would these add to inflation and debt, they would take enormous amounts of resources away from consumers and capital-needy businesses, and spend them on political projects instead.

“Permits, licenses, and other barriers make it difficult for businesses to adapt to COVID-era conditions and hire new employees. Trade barriers are contributing to supply chain problems that could put a damper on holiday spending. Lightening these loads would improve people’s lives as well as economic indicators.”

Comments Off on Jobless Claims Just Fell, but Government Barriers Remain a Problem

Posted in Business Cycles, Economics, labor

A famous scene in the 1990s comedy movie Half Baked has a young Jon Stewart musing about how different everyday activities can be while one is high on cannabis. “I love Al Pacino, man. You ever see Scent of a Woman?” “Yup,” his dealer says. “You ever seen Scent of a Woman—ON WEED? That’s the way to see it, man!” Stewart continues: “You ever see the back of a $20 bill, man?” “No, I don’t know you,” says the now-wary dealer. “You ever see the back of a $20 bill—ON WEED?! There’s some weird shit in there, man!”

This scene may well have inspired Sen. Amy Klobuchar’s (D-MN) new antitrust bill, the American Innovation and Choice Online Act. The Senate version, to be introduced next week, joins an already-introduced House version (H.R. 3816), which would ban online retailers from giving preferential treatment to their private brand products.

Sure, you buy store brand products all the time at the grocery store and from Costco, but have you ever bought store brand products—ONLINE?! The distinction between in-person commerce and online commerce is silly. It’s 2021. Nearly every business, big or small, has at least some online presence, and they have for a while.

Sellers sell and buyers buy. Whether in person, by phone, by mail, or online, all are just different means to the same end. People tend to use whichever method has the lowest transaction costs to get together and make transactions. That’s it. The rest is details, like the man in the bushes on the back of Jon Stewart’s $20 bill, who may or may not have a gun.

Klobuchar and her eight Senate cosponsors have an average age of 66, so most of them may not get even my own dated cultural reference to Half Baked. In fact, the only two sponsors under age 60 are Josh Hawley (R-MO), 41, and Cory Booker (D-NJ), 52. No wonder nearly every congressional hearing on tech issues has at least one “series of tubes” or “Senator, we run ads” moment. Whatever one’s feelings about the tech industry, one should think carefully before giving politicians the power to regulate what they do not understand.

For more tech-savvy members, maybe they are grasping at straws for reasons to regulate companies they dislike, and this was the best they could find.

Whatever the case, the online-offline distinction does not matter for consumers, and it gets blurrier every year. Amazon is opening more brick-and-mortar stores, while Walmart and Target are expanding their online offerings. Sen. Klobuchar’s bill would freeze in time a false dichotomy, and cause consumer harm right in the middle of a difficult economic recovery.

How would the bill work in practice? It would not ban online companies from selling their private brand products, but it would ban them from giving their own products special treatment. Google, for example, would probably not be able to show Google Maps in its search engine, or at least not as a leading search result, which could lead to a lot of frustrated drivers. Amazon’s Prime program might go away entirely. At the very least, Amazon’s house brands would become harder to find and might not qualify for free shipping. There would be plenty of consumer aggravation, and no consumer benefits.

Meanwhile, house brands at physical stores would remain untouched. For decades, store brands such as Costco’s Kirkland have benefited from discounted prices, preferential marketing, and prominent shelf space. Those markets have remained highly competitive, but now that this same business practice is happening online, it is somehow different?

Nobody has yet offered a convincing explanation of why that is the case, let alone why commerce at a physical store is fundamentally different from commerce on a website or app, and therefore should be regulated differently.

The American Innovation and Choice Online Act is clearly not about consumer protection. For progressives, it allows them to express an ideological distaste for big businesses and pursue antitrust-unrelated issues like income inequality. For conservatives, it gives them a way to express their culture war grievances against tech companies—which is about as antitrust-unrelated as it gets.

The bill is also a golden opportunity for rent-seekers. For traditional retailers, it is a way for government to hobble their competitors. That might not be what antitrust advocates intend, but that is how antitrust works in in the real world. The American Innovation and Choice Online Act is only the latest instance of a long tradition of regulatory capture in antitrust policy.

For antitrust policy ideas that are more than half-baked, see CEI’s dedicated antitrust website and Wayne Crews’ and my paper “The Case against Antitrust Law.”

Comments Off on Sen. Klobuchar’s Half-Baked Antitrust Bill

Posted in Antitrust, Economics, Law, Public Choice

Roughly a quarter of all jobs in America now require some sort of occupational license. Sixty years ago, it was about one job in 20. Should tax preparers join the list? The Taxpayer Protection and Preparer Proficiency Act of 2021 (H.R. 4184), introduced by Rep. Jimmy Panetta (D-CA), is the latest legislative attempt to do so. CEI signed onto a coalition letter this week, led by the Institute for Justice, opposing the idea.

The bill is being marketed as a consumer protection measure that would ensure that taxpayers are guaranteed quality service by a knowledgeable tax preparer. In practice, it would harm both consumers and small tax preparers. Like many occupational licensing requirements, licensing of tax preparers is economic protectionism. It would favor big accounting firms over small preparers, while raising consumer prices. The IRS’ ability to approve and deny licenses would give it an additional tool to threaten tax preparers and abuse taxpayers. And it would potentially open black markets for unaccountable “ghost preparers” who work outside the system.

First, the rent-seeking argument. H&R Block and other big firms can afford the time and expense it would take to get their employees licensed. But thousands of individual tax preparers who work part-time to help make ends meet, cannot. They would go out of business, and their customers would have no choice but to turn to the big firms. Actions speak louder than words.

Second, the power to grant licenses is also the power to take them away. If the IRS believes that a tax preparer advocates a little too hard for her clients and saves them too much money, it can put that preparer out of business. Under the bill, the IRS only needs to show in a hearing—which it convenes, for which it sets the procedures, and where the participating personnel are on its payroll—that a preparer is “incompetent” or “disreputable.” These terms are defined so vaguely under 31 U.S. Code § 330 that the IRS can use them almost any way it wishes. Penalties include fines to the preparer and her client, censure, and loss of license.

Third, licensing requirements would open up black markets for “ghost preparers.” Licensing is not free, and businesses pass their increased costs on to consumers. That means people can get cheaper tax preparation services by going to unlicensed “ghost preparers” who do not sign their name onto clients’ returns. While this might save some money, it also lets ghost preparers escape liability for mistakes. That is the opposite of consumer protection.

At the very least, Rep. Panetta should withdraw his bill. But the best long-term reform would be to treat the root of the problem: a 70,000-page tax code that is too complicated for most people to navigate without professional help. The Tax Foundation estimated in 2016 that federal tax compliance alone costs 8.9 billion hours of paperwork and $409 billion. This does not include state and local tax compliance. Those figures have likely gone up in the last five years. There are better uses for those resources, especially during a tough economic recovery.

A simpler tax code would address most of the IRS’ complaints about tax avoidance and save taxpayers time, money, and hassle—and do so in a revenue-neutral way. Big accounting firms, their lobbyists, and their political allies’ losses would be more than offset by the gains to nearly everyone else.

The coalition letter is here. Back in 2010, Caleb O. Brown and I wrote in Investor’s Business Daily about a similar proposal that ultimately failed.

Comments Off on IRS Licensing of Tax Preparers Is Ripe for Abuse

Posted in Economics, labor, Public Choice, regulation, Taxation

Inflation remains high, with September’s numbers coming in at a 5.4 percent annualized rate, the highest number in a decade. The Federal Reserve’s target is 2 percent. While this is not a return to Carter-era stagflation, it is cause for concern. The economic recovery is difficult enough as it is, and high inflation only makes it harder. Inflation not only means higher prices for consumers, it means higher input prices for businesses, and is contributing to supply chain difficulties. That means consumers are facing price increases due to supply-and-demand factors, in addition to inflation.

Inflation is what happens when the amount of money circulating in the economy grows faster than the amount of goods and services. Keeping inflation in check means keeping those numbers in sync. Today’s record deficit spending is pushing them apart, by increasing monetary flows without necessarily increasing the amount of wealth being created. The upcoming trillion-dollar infrastructure bill, $3.5 trillion reconciliation bill, and $6 trillion annual budget will only make matters worse.

The Fed can help by raising interest rates, which it has indicated it might do early next year. Although politically independent, the Fed will likely face political pressure to keep rates low. Low rates can have a temporary, short-term stimulus effect, though at the price of a bust later. And there are the mid-term elections next year, likely before the bill would come due. Higher rates also make the government’s debt payments more expensive, making the big spending bills more difficult to pass.

If Washington wants to get inflation back to target levels, it needs to spend less while removing obstacles to wealth creation. In addition to fiscal restraint and respecting the Fed’s independence, that means easing back on permits, licenses, trade barriers, and financial regulations that are burdening supply chains and making it difficult for businesses to hire workers and create more goods and services.

Comments Off on September Inflation Remains High and Fixable

Posted in Economics, Monetary Theory, Spending